The Briefing

GDP forecasts are being trimmed, consumer confidence is in freefall, and BMW’s Mini plant is cutting jobs. Meanwhile, tariffs are rattling economies. This may be a bumpy Q2.

The UK Brief

UK Growth Forecast Downgraded

The EY ITEM Club slashed the UK’s GDP growth forecast for 2025 from 1.0% to 0.8%. Blame the new US tariffs and limp consumer demand. The IMF chimed in too — now expecting a modest 1.1% bump. not recession level, but optimism is down.

28 April 2025 | Source: EY

Economic Take: Lower GDP means less business investment, weaker job growth, and lower consumption. This may increase pressure on the Bank of England to ease rates faster than expected to revitalise the economy.

BMW Slashes Jobs at Oxford Mini Plant

180 agency workers had their contracts ended at BMW’s Oxford plant. The reason? Declining production and the 25% US tariffs on imported cars. It’s a reminder that when global trade is hit, local jobs bear the brunt.

4 May 2025 | Source: The Guardian

Economic take: UK’s automotive sector contributes 10% to total exports. This news sends a wider reverberation regionally and nationally, for example to the supply chains across the Midlands. However, the cut is equivalent to only 5% of the plant.

Consumer Confidence at Historic Low

Ipsos’s economic optimism index hit -68 — the worst reading since it began in 1978. Just 7% of Brits think things will get better this year. 3 in 4 Britons believe the economic situation will worsen over the year. Inflation, Trump’s tariffs and government policy are among the main reasons for this.

4 May 2025 | Source: Ipsos

Economic take: consumer confidence drives spending. A gloomy public means lower retail sales, lower VAT revenue, and more pressure on policymakers to stimulate growth. This will be difficult as the public purse is becoming increasingly strained.

Global Snapshot

The U.S. Economy Shrinks for First Time in 3 Years

Q1 GDP fell 0.3% as firms front-loaded imports ahead of tariff hikes. Since inflation and interest rates are high, some economists expect a recession.

30 April 2025 | Source: Reuters

Economic take: The UK’s largest trading partner is the US. If America’s economy slows, we will feel it — in exports, investor sentiment, and the pound.

EU Eyes the Pacific, Thanks to Trump

The EU is looking to form closer ties with the CPTPP, a trans-pacific partnership which includes Japan, Mexio, the UK and more, to protect the rules-based global trade system against Trump’s ‘Liberation day’ tariffs.

4 May 2025 | Source: FT

India Seeks Closer Trade Ties With Europe

India’s Commerce Minister Piyush Goyal has been on a tour in Europe, visiting Brussels, London, and Oslo. He is mainly looking to getting exemptions or concessions from carbon taxes on imports. He also was working on potential free trade agreement with the EU.

1 May 2025 | Source: TechUK

Deep Dive: Tariff Troubles – Economics of a Trade War

New tariffs are more than political posturing — they’re economic accelerants and anchors, often at the same time.

What’s Happening?

The US has imposed 25% tariffs on a number of imports — cars, steel, some electronics — citing national interest and trade imbalances. The UK and EU were not targeted directly, however, they are both starting to feel some of the impacts. For example, JLR, a UK car manufacturer, had to pause all exports to the US, to revaluate the situation. They have recently resumed exports.

Business Impact

UK manufacturers like BMW are exposed, as parts cross borders multiple times before final assembly.

Companies can either pass costs to consumers or cut their margins — neither is good for growth.

Economic Consequences

Tariffs are a tax. They artificially distort trade flows, reduce efficiency, and ultimately hinder global GDP growth.

JPMorgan have warned that the Global GDP may fall by 1% due to the US tariffs.

What Experts Say

Gabriella Willis, economist at Santander CIB: "We expect tariff-induced shocks to business investment will echo that of Brexit".

Sanjay Raja, chief UK economist, Deutsche Bank: "We are expecting to see the indirect effects of trade shocks coming through via lower business investment".

Bottom line: Trade wars don’t have a clear winner, on a macro level. As the UK tries to build new post-Brexit trade bridges, this is an unwelcome event.

Source: Reuters

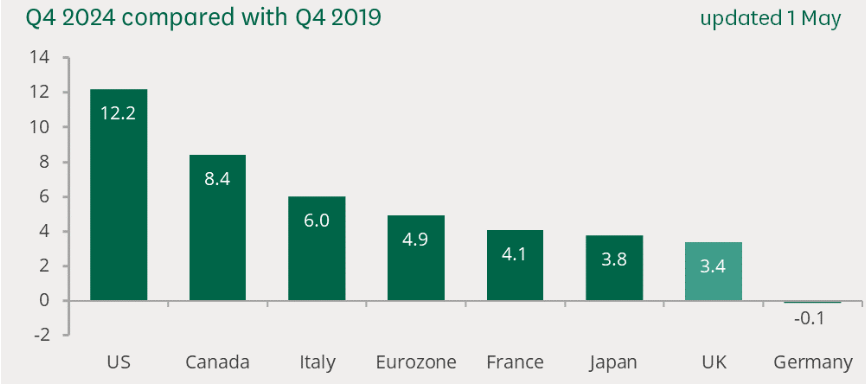

🎯 Guess the Chart

Q1: Does the Chart represent,

A) Real wage growth from pre-pandemic levels?

B) Real GDP growth from pre-pandemic levels?

C) Change in interest rates from pre-pandemic levels?

D) Change in national Debt from pre-pandemic levels?

Source: UK Parliament

Q2: What is the UK's revised GDP growth forecast for 2025, according to the EY ITEM Club?

A) 1.5%

B) 1.0%

C) 0.8%

D) 0.5%

👉 Answers at the bottom!

Answers

B, C

Feel free to contact us with any feedback - All feedback is appreciated.